How RBI tracked cash transaction during demonetisation?

Putting the demonetization deposit as CRR means

banks can't give any loans out of those temporary deposits. Building assets or giving loans out of this very short term money are going to be disastrous for banks as these deposits should tend back quickly. Some

banks made wrong announcements about loan hikes out of the windfall deposit

bonanza.

Demonetization

The withdrawal of

a currency from use as legal tender. The current form of money is take back

from circulation, often to be replaced with new form of money.

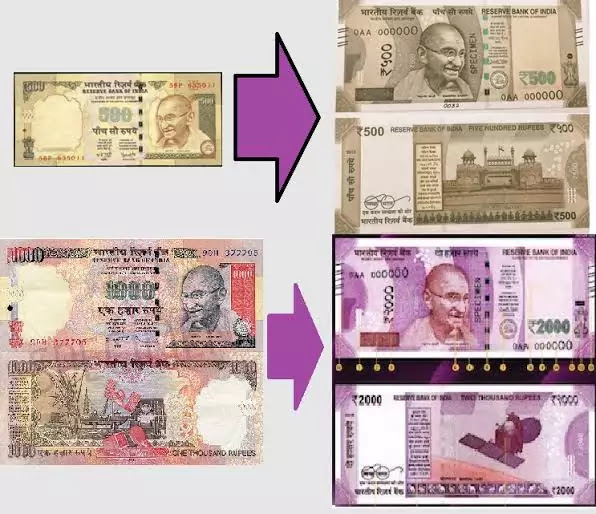

On 8 November

2016, the Government of India announced the demonetization of all Five hundred

and One thousand rupees banknotes that are in circulation. It also announced

the issuance of new Five hundred and One thousand rupees banknotes in exchange

for the demonetized banknotes.

The announcement

of demonetization was followed by lengthy cash shortages in the weeks that

followed, which created significant disruption throughout the nation. People try to exchange they're banknotes had

to stand in lengthy queues.

Reserve Bank of India

The Federal Reserve Bank of India (RBI) is that the central bank

of India, which was established on April l, 1935, under the Reserve Bank of

India Act. Reserve Bank of India uses monetary policy to create financial stability

in India, and its charge with regulating the country's currency and credit systems.

Banknotes in

circulation

On 28 October 2016 the total banknotes in circulation in

India were valued at ₹17.77 lakh crore; what proportion of this derived from

₹500 and ₹1,000 banknotes was unknown. In its annual report of March 2016, the

Reserve Bank of India stated that total banknotes in circulation valued ₹16.42

lakh crore of which nearly 86% derived from ₹500 and ₹1,000 banknotes. In terms

of volume, the report stated that 24% of the total 9026.6 crore banknotes in

circulation were ₹500 and ₹1,000 banknotes.

Before demonetization, their were banknotes worth ₹17.97 lakh

crore in the market. The demonetized banknotes constituted 86.4% of it. The

banknotes in circulation had reached to the level before demonetization in

March 2018. By March 2018, their were banknotes worth ₹18.03 lakh crore in the

market; increase of 9.9%. New banknotes of ₹2,000 and ₹500 constitute 80.6% of

it. So their was only 5.8% increase in small domination banknotes. The volume

of banknotes in the market increased by 2.1%. The banknotes in circulation had

further increased to ₹19.5 lakh crore in September 2018 and ₹21.41 lakh crore

in March 2019, 19.14% higher than the level before demonetization

Steps to Demonetization by RBI

How RBI tracked cash transaction during demonetisation?

How RBI tracked cash transaction during demonetisation?

- As a primary step the financial institution had urged people to make bank accounts under Jan Dhan Yojana. They were asked to deposit all the money in there Jan Dhan accounts and do there future transaction through banking methods only.

- The second step that the financial institution initiated was a tax declaration of the income and had given

- October 30, 2016: deadline for this purpose.

- Government was ready to mop up an enormous amount of undeclared income.

- Government gave part of the salary as cash to its employees

- This might lead to a further increase in shortage of currency.

- There are about four printing presses for currency in India and depending upon the value and number of pieces of Rs.500 and Rs.2000 to be printed

- Might take an extended time taking under consideration the massive scale of withdrawal of the monetary base.

Currency

Exchange

Till 11th Nov, Rs. 500 & Rs. 1,000 notes will be

accepted at:

- Petrol, Diesel & Gas Stations, Consumer co-operative stores, Milk booths authorized State Government

- From 10th Nov to 30th Dec you can deposit you're Rs. 500 & Rs. 1,000 notes at Banks & Post Offices

- Withdrawal Limit until notified ATM Limited to 2,000 per day

- BANK

Limited to 10,000 per day

Limited to 20,000 per week

- RBI

New 500 & 2,000 currency will be issued by RBI

4,000 can be exchanged per day till 24th Nov.

25th Nov onwards this limit will be increased.

FILE CASH DEPOSIT DETAILS IN INCOME TAX RETURN 2 LAKH OR MORE DURING

09/11/2016 TO 30/12/2016

Income Tax department has issued New

ITR Form AY 2016-17 .Few changes has been made in ITR forms but one among the

main changes is taxpayers who deposited Rs 2 lakh or more post demonetization, will

need to make this disclosure within the new tax Returns (ITRs) forms notified.

The information has got to be

furnished on all the ITR forms 1 to 7 including the new one-page, simplified

ITR-1 'Sahaj' for taxpayers who have income from salary, a house property or

earn interest totaling up to Rs 50 lakh.

Column Part-E of the ITR-1 form seeks

information on cash deposits made by the assessee between November 9, 2016 and

December 30, 2016 if the "aggregate cash deposits" during this period

were Rs 2 lakh or more.

As you may aware that two year back

details of all bank accounts has been added in ITR forms from AY 2015-16. In

this section, one column has been added for cash deposited during 09/11/2016 to

30/12/2016.The detail is required to be filed only if you have deposited equal

or more than 2 lakh in aggregate in all such accounts. Further column for

closing balance of account as required in earlier returns has been removed.

Earlier PM and FM and other

authorities has clearly mention through various ads in TV News papers that no

question and details will be asked from persons who has deposited cash in bank

accounts up to 2.50 lakhs during demonetization.

Later tax department has asked

details of money deposited to 18 Lakh persons operational clean money in new

tab at tax India E-filing site under tab CASH TRANSACTION 2016 through online

question answers ,out of 18 Lakh persons around 7 lakh persons have not

responded to the notice at all.

The department has also made

furnishing of the 12-digit Aadhaar number mandatory and if it is not available

the 28-digit Aadhaar enrollment id should be made available. This rules is

applicable from 01.07.2016.

The CBDT, the policy-making body of

the tax department, has also reduced the entire number of ITRs forms to seven

from the previous nine.

ITR 2A has been deleted, Further ITR

4 has also been deleted and merged with ITR-3.

CRR and Demonetization

RBI has asked banks to take care of an incremental cash reserve ratio of 100% to soak up the surplus liquidity.

The cash is now a liability as banks need to pay interest on savings accounts, but they're not earning interest under the new 100% reserve requirement

rule.

Conclusions:

- Visible difference will come if the government uses demonetisation to persuade two intermediaries in the value chain — the trader and the village shopkeeper — to adopt electronic payments.

- All the APMC markets are regulated by state governments & used by the larger traders. 'They should be made cash-free.

- Cash is an inefficient medium of exchange. The World Bank estimates that the Indian govt., can save 1% of the GDP annually from digitising current cash-based subsidies alone.

Reference and Credits to:

0 Comments

Please do not enter any spam link in the comment box.